maryland digital advertising tax proposed regulations

Maryland Relay 711 Comptroller of Maryland. Guidance on the digital advertising gross revenues tax in the future and will adopt regulations that determine the state from which revenues from digital advertising services are derived.

Maryland Enacts Nation S First Digital Advertising Tax With Strict Penalties For Noncompliance Subject To Immediate Challenges Thought Leadership Baker Botts

Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country.

. The Maryland legislature overrode Governor Larry Hogans veto of a new tax on digital advertising HB. On August 31 2021 the Maryland Comptroller filed proposed regulations on the controversial digital advertising gross revenues tax the DAT with the Joint Committee on. 732 on February 12 2021 making Maryland the first state in the.

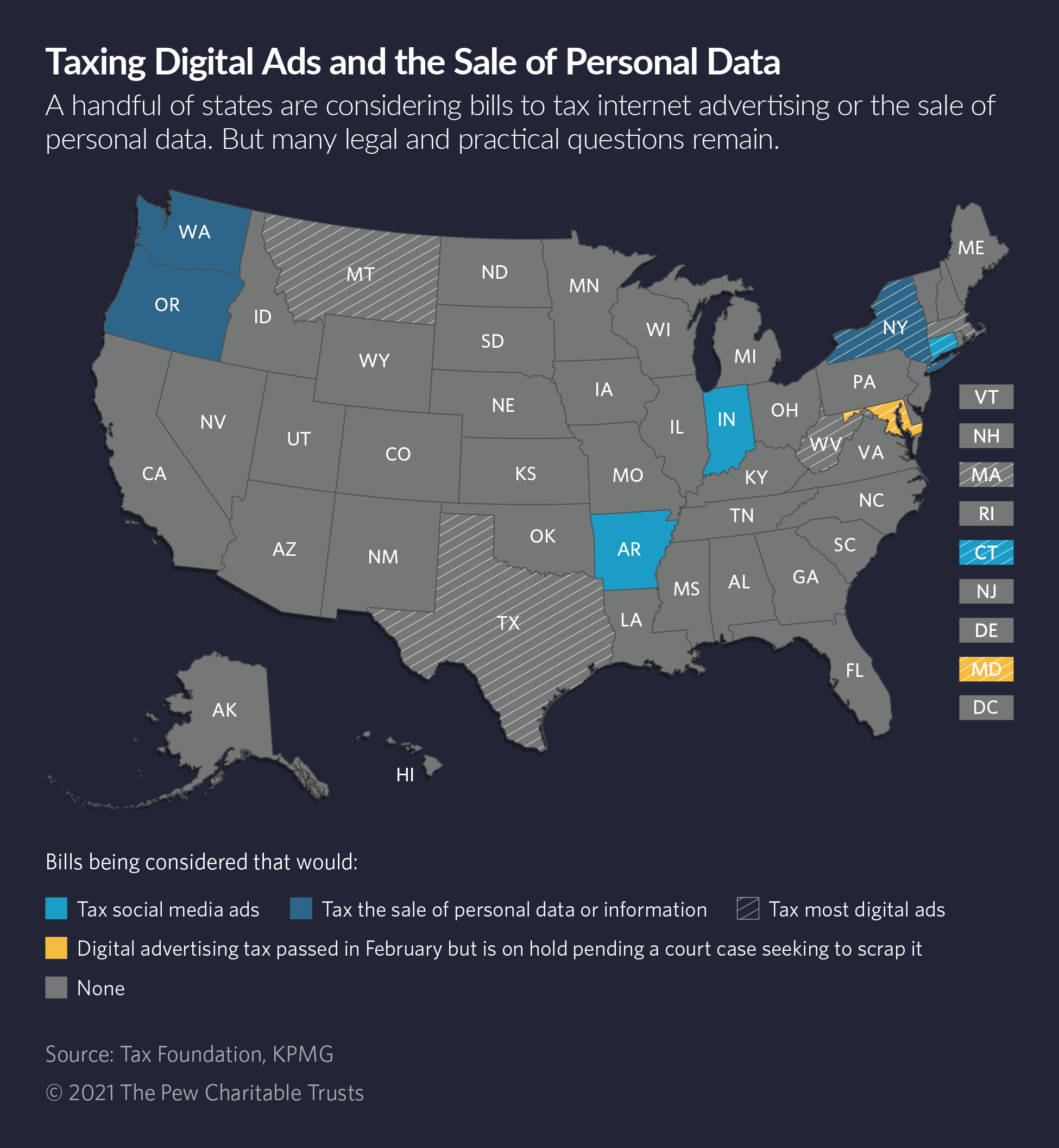

On August 30 the Maryland comptroller filed proposed regulations with the states Joint Committee on Administrative Executive and Legislative Review to clarify how businesses. The 4As along with many other advertising. The legality of Maryland digital ad tax law is being watched closely by other states that have also weighed a similar tax for online ads.

Tuesday October 18 2022. 1 This tax which is intended to be imposed on the. Proposed digital advertising tax regulations were filed on August 31 by Marylands comptroller.

Saturday December 4 2021. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of. On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations.

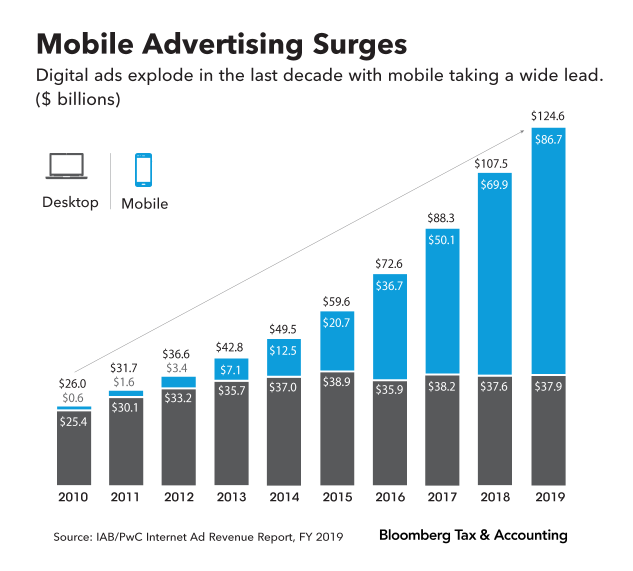

On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation proposed Md. In the December 3 2021 issue of the Maryland Register the Comptroller confirmed that it adopted regulations to the Digital Advertising Gross Revenues Tax on November 24. The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising.

On December 3 2021 the Maryland Comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax.

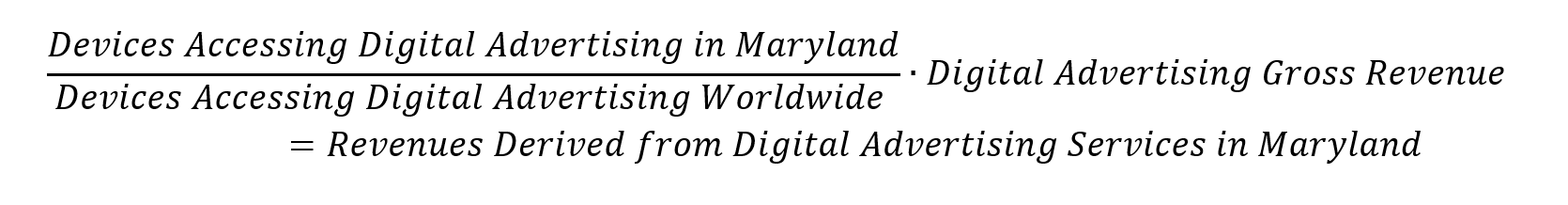

A Maryland circuit court judge has struck down Marylands first-in-the-nation digital advertising tax Digital Ad Tax. In simple terms the proposed regulations would require companies that derive revenue from.

Maryland To Delay Controversial Digital Advertising Tax As The Lawsuits Keep Coming

Maryland S Digital Advertising Tax Is Unworkably Vague

Digital Ad Tax Suit In Maryland Becomes Test Of States Rights

Maryland Digital Advertising Tax Legislation Violates Itfa

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Internet Ads Are A Popular Tax Target For Both Parties The Pew Charitable Trusts

Maryland S Digital Ad Tax Getting Axed Offers Pause To States

Maryland S Digital Ads Tax Struck Down In Blow To Other States Protocol

Maryland S Digital Ad Tax Under Pressure From Big Tech

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Maryland Judge Strikes Down Nation S First Digital Ad Tax Cbs Baltimore

The Fight Over Maryland S Digital Advertising Tax Part 2 Audio Only Youtube

Maryland Enacts New Legally Fraught Digital Advertising Tax Gallagher Evelius Jones Llp Attorneys At Law

Maryland Digital Advertising Tax Regulations Tax Foundation Comments